Employee benefit programs are crucial for the recruitment and retention of top talent. In a highly competitive business environment, a well-drafted and well-administered employee benefit plan can lower an employer’s costs and provide a competitive advantage. We advise employers on all aspects of benefit-related laws and we work closely with clients to develop, implement, and maintain a benefits strategy that supports the company’s overall business objectives.

Our expertise spans the full range of employee benefit services, from plan design, strategy, and implementation to legal and regulatory compliance, taxation, and litigation.

We counsel employers on a wide range of benefit programs, including:

- 401(k) and profit-sharing plans

- Pension plans, including traditional, cash balance, pension equity, and other hybrid plans

- 403(b) and 457 plans for tax-exempt and governmental employers

- Employee stock ownership plans (ESOPs)

- Executive compensation, including nonqualified and performance-driven plans

- Stock-based plans, including phantom and restricted stock

- Group insurance plans

- Health and welfare plans

- Self-funded health and disability plans

- Consumer-driven health care solutions, including health savings accounts (HSAs) and flexible spending accounts (FSAs)

- Cafeteria plans

- Fringe benefit plans

- COBRA, HIPAA, Medicare, and Affordable Care Act issues

- Association health and retirement plans

- Multiemployer and multiple employer plans, including multiple employer welfare arrangements (MEWAs)

- Fiduciary responsibility, education, and best practices

When plans have been administered improperly, we assist clients in identifying and fixing the problems. We advocate on behalf of clients before the Internal Revenue Service, the Department of Labor, and the Pension Benefit Guaranty Corporation, as well as in appellate, bankruptcy, and federal district courts. We also handle employee benefits issues in mergers and acquisitions, company restructuring, and litigation.

Our clients are a diverse group of employers, from publicly traded to closely-held companies, nonprofit groups, hospitals, associations, and governmental entities. We appreciate that each employer has different needs and objectives, and we work with each client to create plans that are right for them. Our strength lies in helping clients to navigate the complex laws and regulations governing plans, avoid compliance issues, and resolve problems efficiently.

Watch the Employee Benefits Group’s recent webinars from the Breaking Down SECURE 2.0 series:

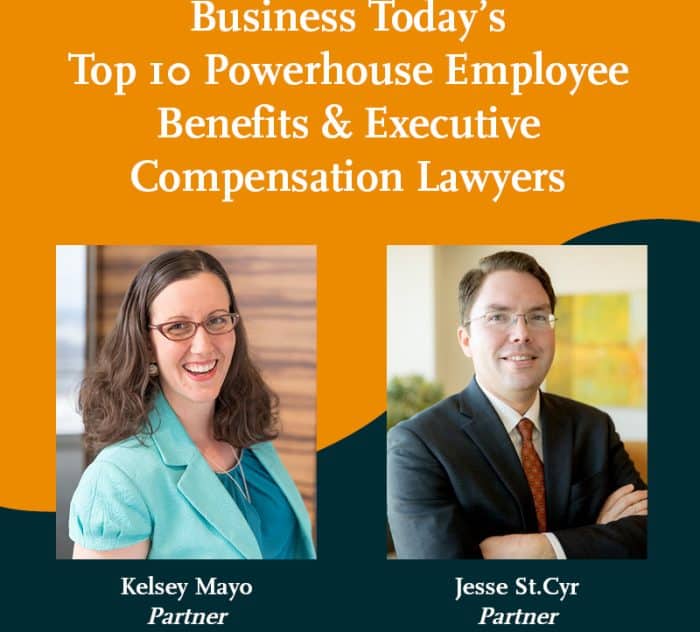

For more information, contact one of the related professionals on this page.

◀︎ Back to All Business Services